As two major forces in the global sportswear manufacturing industry, China and Vietnam have both established influential positions. China maintains leadership through its complete industrial chain and technological capabilities, while Vietnam rises rapidly due to its significant cost advantages. The following comparison analyzes both countries across five dimensions: cost, supply chain, technology, market suitability, and international brand dependence.

1. Cost Comparison

China: Higher Labor Costs

China’s average hourly wage of $4.50 is substantially higher than Vietnam’s $2.50. Minimum wages in major Chinese cities also exceed $350 per month, creating notable labor cost pressure.

Although a mature supply chain can offset some expenses, the overall production unit cost remains higher. This makes China less competitive for large, price-sensitive basic orders—yet China sportswear manufacturers often compensate with efficiency and value-added capabilities.

Vietnam: Strong Cost Advantage

Vietnam’s labor cost averages just one-third of China’s, with the lowest regional minimum wage at $125 per month. This advantage is a major driver behind multinational brands shifting capacity to Vietnam.

However, Vietnam imports 70% of its textile raw materials from China, adding extra logistical and procurement costs that partially reduce the benefit of low labor prices.

2. Supply Chain and Infrastructure

China: Complete Industrial Chain & Efficient Logistics

China possesses the world’s most comprehensive textile and garment supply chain. From functional fabrics and accessories to dyeing and finishing, nearly all processes can be completed domestically. Leading companies such as Shenzhou International provide end-to-end solutions, from fabric R&D to final garment production.

Additionally, China’s advanced logistics network—railways, ports, and express systems—ensures short lead times and consistent reliability, making it ideal for fast and large-scale sportswear orders.

Vietnam: Weaker Supply Chain, Improving Infrastructure

In Vietnam, around 70% of textile factories specialize only in basic sewing, with limited capacity in fabric production or dyeing. The country imports $16 billion in textile materials annually, nearly 70% from China.

Logistics costs account for 20.9% of GDP, far above the global average. Although ports and road networks continue to improve, they still cannot match China’s efficiency, resulting in longer lead times—especially for sportswear reliant on imported raw materials.

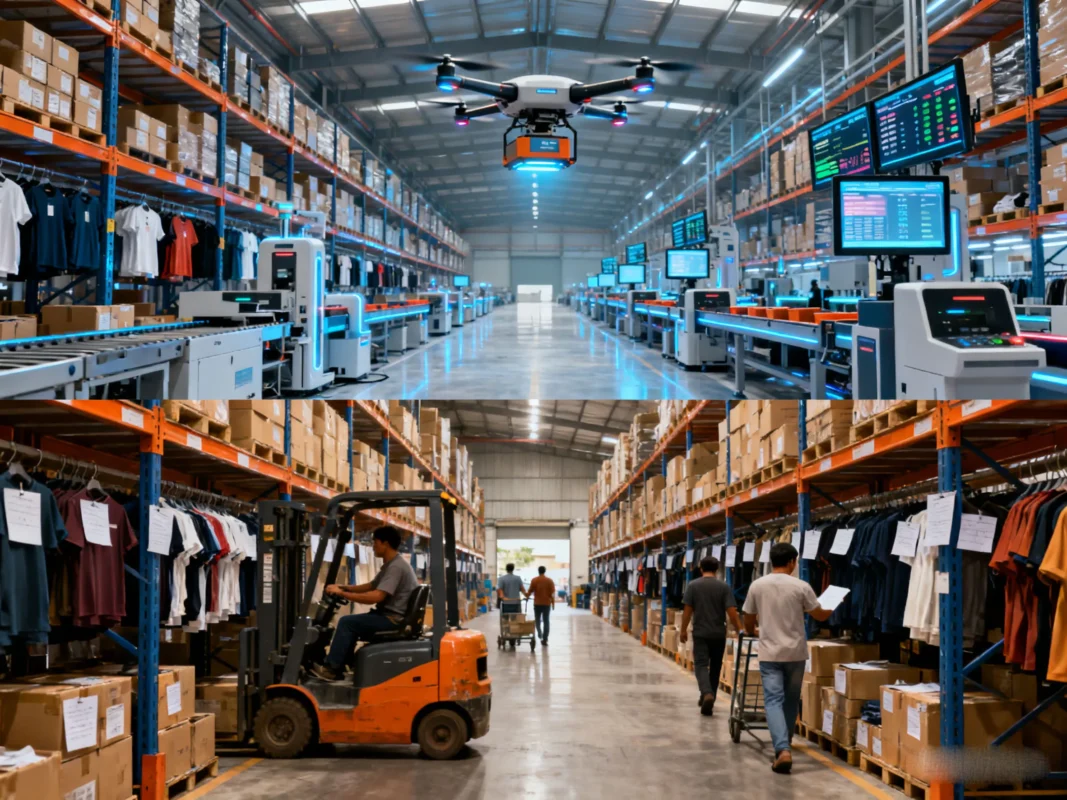

3. Technology and Production Capability

China: Advanced Technology and Strong Customization

China has significant advantages in high-end manufacturing, including seamless bonding, laser cutting, and innovative material development such as supercritical foaming. This makes China sportswear manufacturers especially suitable for high-performance and highly functional sportswear.

Factories in China also maintain high yield rates and robust production management systems, handling complex, diverse, and precision-dependent orders with stability.

Vietnam: Improving Quality but Limited in High-End Processes

While Vietnam’s quality in basic sportswear has improved—attracting brands like Nike and Adidas—its advanced manufacturing capabilities remain weaker.

Only a small number of factories can support high-value processes such as bonding or adhesive techniques. Worker training cycles are shorter, leading to lower yield rates in complex functional apparel production. Vietnam is therefore better suited for mass production of standard T-shirts, sweatpants, and other basic items.

4. Market and Brand Suitability

China: Best for High-End, Complex, and Customized Orders

China’s strong technology base and flexible manufacturing make it the preferred location for premium sportswear brands. It supports both international markets (Europe, the U.S., the Middle East) and domestic leaders such as Anta and Li-Ning.

China’s large consumer market also provides steady demand, helping factories continuously upgrade technology and expand product capabilities.

Vietnam: Ideal for Cost-Effective Bulk Production

Vietnam’s primary advantage lies in producing low-cost, standardized sportswear for brands that prioritize affordability.

However, Vietnam’s small domestic market and high reliance on exports pose risk. In the first three quarters of 2024, textile orders dropped 80%, causing nearly 40,000 factories to close—highlighting its vulnerability.

5. International Brand Strategy and Industry Dependence

China: Maintains Control of Core Processes

Although some brands have redistributed production to reduce risk, China still holds vital positions within the global value chain. For example, Nike’s number of factories in China fell from 195 to 159 over the past decade, yet Vietnam’s major Nike facilities still rely heavily on Chinese technology, equipment, and raw material supply.

This reinforces the continuing importance of China sportswear manufacturers in global sportswear production.

Vietnam: A Key Production Hub, but Highly Dependent

Vietnam has surpassed China as Nike’s largest manufacturing base, producing:

- 51% of Nike’s footwear

- 31% of its apparel

Nevertheless, its reliance on Chinese materials and transplanted management systems keeps industrial autonomy relatively weak.

Conclusion

- China excels in advanced manufacturing, a complete supply chain, and high-end, customized sportswear production.

- Vietnam offers strong cost advantages and is suitable for large-scale, basic, standardized manufacturing.

The two countries now form a complementary relationship within the global sportswear industry, but China continues to hold a leading position in key technologies and supply chain strength.

Views: 0